This proposal is a collaboration between the team behind Project Omega (working title) and the core contributors of Akropolis. We welcome feedback and engagement, both on the forum and directly to us, about this proposal and how it can drive success for Akropolis and $AKRO.

Summary

This proposal puts forward a plan to reinvigorate the Akropolis project, enable it to incentivise new and old contributors, support the funding of a product roadmap aiming to revolutionise the Bitcoin ecosystem, and ultimately, accrue value to $AKRO token holders by encapturing a wider range of use cases. As part of this transition, Akropolis will actually be rebranding as Project Omega, with the final name to be revealed later. This rebrand reflects our broader strategic shift and is aligned with the new tokenomics and product roadmap we’ve outlined.

This proposal outlines and puts forward:

- New contributors and key new product initiative with Project Omega

- New token economics for $AKRO

- New project roadmap

Background

Akropolis transitioned to a DAO two years ago in 2022, and handed over the contribution initiatives to the community. However, since then, community contribution has been extremely limited if any, for various reasons. They key reason being misaligned incentives for participation in the broader DeFi ecosystem

$AKRO’s current circulation is 88% of the maximum supply, with limited treasury reserves remaining to incentivise future growth via new core contributors. This makes it impossible to fund a viable roadmap for product development and build a suitable marketing budget. Without a thoughtful restructuring of Akropolis and $AKRO, the protocol’s future is unquestionably limited.

Proposal

To address this, core Akropolis contributors and a new core contributor candidate team have joined forces to put forward the following remedial plan for the future of Akropolis:

- Introduction of the proposed Project Omega roadmap, a BTC UTXO sidechain with enhanced EVM compatibility

- Progress to date on Project Omega’s development

- An $AKRO token restructuring to enable and fund the new product roadmap;

- Token model restructuring to enable move from a dApp token to a new L1/L0 native utility token that secures the chain.

New Product

The original Akropolis whitepaper envisioned a yield disconnected from the broader banking system. The team later progressed to building a DeFi yield aggregator on the Ethereum network. Our grand vision envisaged incorporating Akropolis’s tech cross-chain, integrating Bitcoin’s liquidity with Ethereum’s established DeFi ecosystem. However, it soon became clear that without a strong technical expertise, secure yield generation, specifically for BTC, cannot be created without a purpose-built blockchain/omnichain.

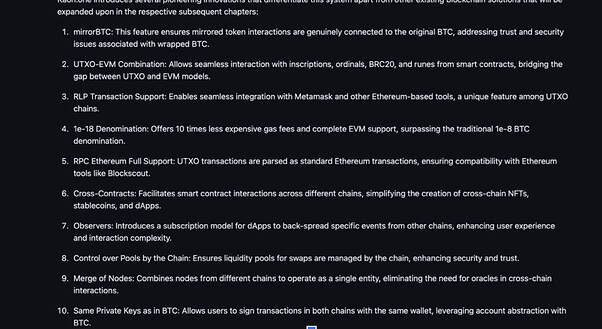

Enter the new potential core contributor. The stacked 10-person team comes with a fully developed dPoS-based blockchain (currently in testnet) that combines UTXO-based security architecture with an EVM infrastructural layer. Technically speaking, it is a BTC sidechain with EVM functionality. This design enables it to facilitate secure cross-chain transactions and deepen on-chain BTC liquidity. It possesses several standout proprietary features that enable unique and previously impossible interactions. See Gitbook chapter sneak preview below:

Such infrastructure, trustlessly securing BTC and EVM cross-chain asset transfers, allows this platform to gain native interaction with a wide range of BTC liquidity pools while bringing Ethereum’s DeFi functionality to Bitcoin. By using these advanced security measures, common vulnerabilities are effectively mitigated, ensuring a safer and more reliable ecosystem for the wider blockchain industry. The scope of potential use cases is wide, from cost-effective cross-chain BTC liquidity pools to enabling a cheap cross-chain memecoin infrastructure.

Institutional capital has been rapidly flowing into cryptoassets since the landmark approvals of Bitcoin and Ethereum ETFs by the SEC. While strides have been made, the lack of reliable critical BTC-native DeFi infrastructure restricts the flow of this capital onchain and limits secure yield-generation opportunities. This presents a golden opportunity to create value for $AKRO token holders. By integrating $AKRO as this new layer’s utility token we can distribute substantial value creation to the tokenholders.

ELI5:

- The new chain combines Bitcoin’s UTXO security (for tracking transactions) with Ethereum’s EVM (for smart contracts), essentially becoming BTC sidechain on ETH and enabling secure and flexible cross-chain transactions.

- This boosts BTC liquidity on other chains and allows for new types of interactions, making the ecosystem safer and more reliable.

- The unique infrastructure supports various uses, including:

- Secure transfers of large amount of BTC using L1 open architecture;

- Miners can keep BTC on the balance sheet without relying on wrapped or alternative BTCs, using a merged compile of code bases to operate in both chains;

- Trading BTC on DEX & buying BTC on EVM-compatible chains with Metamask.

New Team

After spending a year searching and vetting for the right partners to facilitate new progress in $AKRO, this new initiative has been made possible by the new team’s expertise, shared vision and values.

Team Background:

-

A 10-person strong engineering team, with average development experience of 5+ yrs, and senior engineers with up to 15-20 yrs experience.

-

[work in progress] BRC Council partners: contributors to the development of the BRC-20 token standard;

-

[work in progress] Open source contribution to Bitcoin Rust codebase;

-

Team led by an experienced developer and CTO, with 15 years of senior leadership experience in large institutions, including a large mortgage issuer, where he has led a 250-strong team with a multi-million-dollar budget. An active pseudoanon crypto ecosystem participant since 2017. In 2021, he founded an audit and whitehat cybersecurity firm that secured over $10bn of digital assets to date. It is this security-first mindset and exposure to poorly designed and executed solutions from a security and audit perspective that laid the foundation of the Project Omega.

Progress to Date

- The core contributing team have already contributed a substantial code base with a large volume of the original code to the project’s Github;

- Project Omega has been in development for ca.3 years with a very substantial volume of original code;

- Over $2.0mn in development and infrastructure cost invested to date.

- Working with Deep Work, a renowned design studio behind projects like Gnosis, ConsenSys, and the Ethereum Foundation, to develop the new brand identity.

- Progress to date is detailed on the roadmap.

New Roadmap

- Quarterly roadmap for the testnet iterations and progression to mainnet is here.

Establishing Foundation for the existing DAO

We propose to establish the AKRO Foundation (name subject to change) as a Cayman Islands foundation company, to serve as a legal wrapper for the AKRO DAO. This foundation will be ownerless, with no members or shareholders, and will be managed by the director(s) or board under the oversight of a supervisor. The foundation will be established for purposes associated with the Akropolis project and AKRO DAO, including facilitating the development of the project, its decentralization, financing project-related activities, managing associated infrastructure, etc. This foundation will be reasonably subordinated to the AKRO DAO. The composition of the initial director(s) and supervisor(s) will be determined by the AKRO DAO core contributors as they deem advisable or desirable.

We further seek the DAO’s consent for the transfer of the AKRO token smart contract to the foundation immediately following its formation. After this transfer takes place, the AKRO smart contract will be managed by the foundation, including for exercising the new token mint, as explained in this proposal. The current controlling multisig and its composition will remain intact. The foundation may further accept other on-chain assets and contracts, and other property associated with or attributable to the AKRO DAO.

New Generation Tokenomics, Phase 1

$AKRO has ca.88% of its tokens in circulation. After careful consideration, a potential move from a dApp token to an L1/L0 token will require creation of 10 Billion new $AKRO tokens for a range of requirements, outlined below:

-

A new dPoS network security and decentralisation for node operators - a wide, decentralised distribution will be a main focus. Appropriate incentives for maximum distribution are key for the network’s success;

-

To implement $AKRO as the new layer’s native utility token that secures the chain, we’ve determined that moving from a dApp token to one that can sustain both dApps and native-chain utility will require new allocations of $AKRO.

-

New roadmap, enabling hiring and retention of new talent;

-

Server infrastructure costs;

-

Fundraising;

-

Business Development partnerships and marketing;

-

Ecosystem growth incentives, including airdrops, staking rewards, and node operator rewards.

Like with any cryptocurrency project, the above are imperative for the success of the project.

The new tokens are proposed to be allocated strategically to several stakeholder categories and released gradually over a four-year vesting period to ensure market stability and support sustainable growth. The vesting process follows a block-by-block release, with a portion of the tokens governed by an event-driven vesting mechanism, ensuring that key roadmap milestones like testnet and mainnet launches are achieved before certain token allocations are unlocked.

| Category | Percentage | Tokens ($AKRO) | Vesting terms |

|---|---|---|---|

| Team | 20% | 2,000,000,000 | 75% of the Team allocation is locked for 12 months and vested over 3 years, with block-by-block release. 25% of the team allocation is subject to event-driven vesting. |

| Foundation | 10% | 1,000,000,000 | 10% (100,000,000 AKRO) fully liquid upon minting, the rest vested over 4 years, with tokens vested block-by-block. |

| Ecosystem Growth and Fundraising | 60% | 6,000,000,000 | Vested over 4 years, with tokens vested block by block, of which 15% are subject to event-driven vesting. To be managed by a Foundation. |

| Market Making | 5% | 500,000,000 | Fully liquid upon minting. |

| Partnerships/ Incentives | 5% | 500,000,000 | Fully liquid upon minting. |

| Total New Tokens | 100% | 10,000,000,000 | – |

Our plan would bring the new total $AKRO supply to 15 billion (10 billion new mint + 5 billion existing supply). Of this, 7.33% of the total supply will be immediately liquid upon minting (Market Making, Partnerships/Incentives, and 10% of the Foundation’s allocation), while the remaining 92.67% will be vested over four years, with the majority vested block-by-block.

Event-Driven Vesting

To ensure alignment with the project milestones, 15% of the Ecosystem Growth and Fundraising tokens and 25% of Team tokens will be subject to event-driven vesting. This means tokens will only unlock upon achieving specific, verifiable milestones, such as the testnet and mainnet launches. If delays occur, the corresponding tokens will not be released until the milestones are completed. This approach ensures that development progress is incentivized and maintains accountability, reducing the risk of supply shocks and supporting long-term ecosystem sustainability.

This gradual vesting process provides a steady and controlled release of tokens, minimizing market volatility and aligning the team with the community.

To protect token holders and ensure a smooth transition, the new token economics allocation strategy can be broadly split into (a) short-term stabilisation and (b) long-term value creation groups:

Short Term Stabilisation

| Category | Purpose | Effect |

|---|---|---|

| Market Making | Provide liquidity by buying and selling tokens into and out of liquidity pools | Stabilises token price, reduces volatility, and improves overall market health |

Long Term Value Creation

| Category | Purpose | Effect |

|---|---|---|

| Team | Incentivise team to remain committed to the project’s long-term success through a four-year vesting schedule | Aligns team’s incentives with project growth, ensuring long-term commitment |

| Foundation | Support foundation’s activities including development, marketing, and strategic initiatives | Ensures judicious use of tokens over time to support project sustainability and growth |

| Ecosystem Growth | Support ecosystem-building activities such as developer grants, user incentives, partnerships, and other adoption-driving initiatives | Aims to create a vibrant and active community, driving long-term demand and value for the $AKRO token |

| Partnerships/ Incentives | Form strategic partnerships and offer incentives to early adopters and key stakeholders | Drives early adoption, enhances network effects, and builds a strong foundation for future growth |

Additional emissions are a tried-and-true method for companies and projects to secure the funding they need to maintain operations and fund growth. This money injection, alongside strategic deployment, allows them to speed up development, invest in cutting-edge technologies, and scale their operations, as this proposal intends for the ecosystem. Both crypto and traditional finance have used this approach with great success, with notable examples being Solana, Synthetix, Merit Circle, and Frontier Wallet → Selfchain.

Future Work

Should this proposal pass successfully, you can expect to hear from the new team on the following by end of August 2024:

- Incentives for $AKRO stakers;

- Upgrading staking contract to enable new functionality and incentive mechanisms;

- Upgrade $AKRO token contract and token model (to allow people to interact with testnet);

- Testnet and validator terms;

- Developer and User documentation release

- New branding and visual identity.

Timeline

- Review period: The AIP-017 will be open for discussion for 7 days from 22 June, 2024 until 29 June, 2024.

- Voting period: A snapshot vote will be posted on June 29, 2024 for voting, open for 3 days, starting on 29 June 2024 and concluding July 2, 2024.

- After completing the snapshot, the vote outcome will be executed immediately and the new team will begin onboarding to Akropolis.

- If successful, the newly named project will launch on Mainnet this year after completion with Akropolis community members receiving priority access during a guarded launch.

We sincerely hope that the Akropolis community comes together to support this proposal, and use their voting power to reposition the project for a meaningful, bright future.

Onwards!

Project Omega and Akropolis core teams.