Author

Cryptoz

TLDR Summary

- Create new vesting mechanism that gives stakers the right to withdraw at least 50% of their reward at anytime during the vesting period at varying costs.

- Use vesting mechanism to raise fund for development and marketing purposes.

- Introduce tokens burns and lock mechanism to create scarcity to decrease sell pressure

Introduction/Rationale

Briefly:

The vesting period was created to stop stakers from continuously selling their rewards and hurting the price of $AKRO. Although it seems to have had a positive impact, it is not perfect:

- There are constant selling pressures at key price levels due to the amount of tokens in circulation.

- The current vesting mechanism is not attractive to investors who would prefer to have access to their rewards in part or in full at any time during the vesting period.

- Smaller investors cannot reach the 10K tokens release limit as fast as big investors can.

The following mechanism aims to give stakers the ability to withdraw parts of their rewards anytime during the vesting period- at varying cost, raise funds for development/marketing and organically reduce the amount of tokens in circulation- which in turn to help the price of $AKRO.

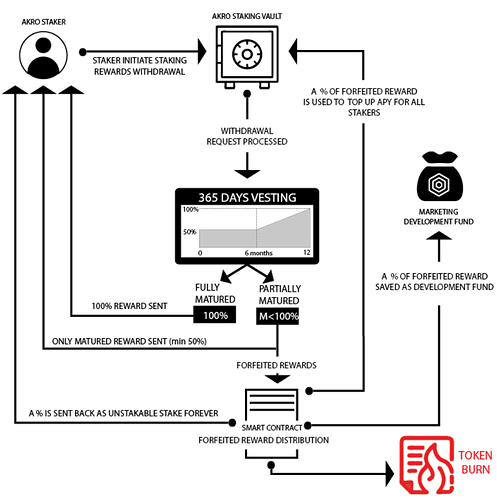

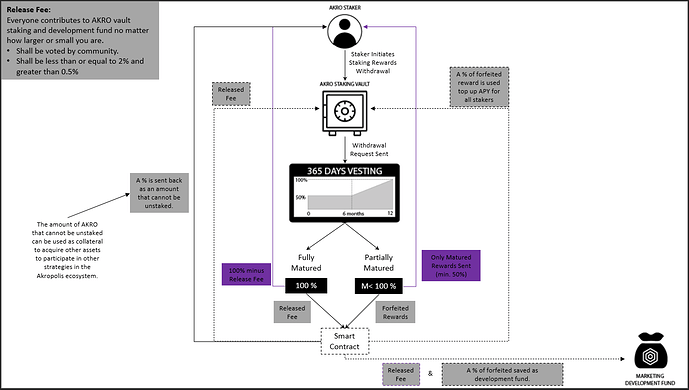

Mechanism Basics:

Tokens rewards are vested for 365 days. For the first 6 months, any staker who wishes to, can withdraw 50% of his earned rewards and forfeit the remaining 50% for distribution. After 6 months, his rewards mature linearly until the vesting period is over.

We have two different scenarios possible:

Scenario 1:

Staker 1 wants to withdraw his rewards before the vesting period is over, during month 5 for example. He initiates a withdrawal request and receive 50% of his reward. The remaining 50% (unmatured) are sent to a smart contract for distribution:

- Staker 1 will receive part of the remaining 50% as staked tokens that can never be unstaked.

- A portion will be sent to top up a development and marketing fund.

- A portion will be used to top up the APY of the AKRO staking vault.

- A portion will be burned.

NOTE: Distribution quotas are yet to be decided.

Scenario 2:

Staker 2 wants to withdraw his rewards at the end of the vesting period. He initiates a withdrawal request and receives 100% of his reward.

Conclusion

The community should consider this proposal as it rewards long term investment but also gives the freedom to use rewards at anytime during the vesting period. Introducing token lock and burn should also help the price in the long run as it would decrease the amount of tokens in circulation. Lastly, anyone invested in this project should appreciate the need for a development and marketing fund to help us compete with other well funded projects.

Disclosure: The idea behind this mechanism came from another project called Delta Financial.

I hope I have made myself clear but please do let me know if you have any questions and I will be happy to respond.

I hope I have made myself clear but please do let me know if you have any questions and I will be happy to respond.